WeWork could be no more

What happened?

Shares sank after WeWork, a coworking company, stated that they will skip a series of interest payments totalling more than $95 million.

It comes after the company said it had “substantial doubt” about its ability to stay afloat over the next year. The missed interest payments will give it some time to negotiate with creditors and come up with a plan to save the company.

The move has raised questions about whether the company is progressing toward bankruptcy.

WeWork: a quick glance

What: They are a co-working company offering workspaces all over the world in the form of meeting rooms, hot desks and more.

Founders: Adam Neumann, Miguel McKelvey, Rebekah Neumann. Current CEO: Sandeep Mathrani

Launched: 2010, New York

Location: 779 locations in 39 countries.

Market Share: 1.70%, according to RubyHome

Image courtesy of CTech

WeWork’s rapid rise

The company launched in 2010 and by 2019, of a valuation of $47 billion. How did they rise so fast?

2010 was a good time to start a co-working company. There were landlords with lots of empty buildings and vacant offices and they wanted them to be used. WeWork presented an attractive solution to the landlords and they were signing leases left, right and centre.

From 2010 to 2011, WeWork doubled in size, and from 2011 until its troubles in 2019, they grew exponentially.

Image courtesy of Bloomberg Originals

With early investments, from venture capital firms such as Benchmark Capital, they expanded to 32 locations across the US. By 2015, the company had acquired 21 start-ups and had around 23,000 paying customers. They also had a valuation of $10 billion.

Image courtesy of Business Insider

Other investors included real estate developer Greenland Holdings and private equity firm Hony Capital. However, the crucial investor for WeWork’s rapid rise was SoftBank. Between 2017 and 2018, SoftBank invested around $8bn into the company. Part of SoftBank’s investment was to aid the company’s expansion into the Asian market. With SoftBank’s aid, they had a valuation of $20bn in 2017.

Image courtesy of Business Insider

By late 2019, they had over 485 locations across the world and a valuation of $47 billion. This was more than Airbnb. Stripe and Space X.

Image courtesy of Bloomberg Originals

What made WeWork so attractive?

WeWork had:

· A flexible workspace model and features. This enabled them to offer a wide range of membership prices such as, All Access, to dedicated desks and On Demand services and more. The variety catered to all sorts of freelancers, remote workers and giant corporations encouraging growth opportunities and providing stability.

· Modern amenities such as communal areas and networking events. This made WeWork more than just a company – it was one that fostered community and collaboration.

· Heavy investment into technology integration. They invested a lot into making the customer experience as seamless as possible. With the development of their app, it allowed customers to book tables or meeting rooms with just a few clicks.

· A visionary leader. WeWork was not Adam Neumann’s first venture. He launched Greendesk with a co-founder and sold it later on. WeWork had other ventures, such as WeGrow their elementary school venture (which closed down in 2019).

Image courtesy of Deadline

Softbank’s Vision Fund

Image courtesy of CNN

As you can see, SoftBank has invested in quite a few businesses. Notable ones include Uber, Arm and Slack.

2019: The Year of the Downfall

With global expansion occurring and more customers paying for their services, things seemed to be going pretty well for the company. With this in mind, Neumann wanted to take the next step- to list on the New York Stock Exchange. This is a decision that the then CEO would come to regret.

When a company goes public, they have to follow certain rules. Some of these are:

· Telling investors how much its shares will cost

· Letting investors know when they can start buying them

Note something interesting:

SoftBank’s investment caused WeWork to have a valuation of $47 billion and people were shocked. It was an unusually high figure and at the very top end of their valuation. At the time, IWG (now known as Regus), which is a similar company as WeWork, was trading at a fraction of what WeWork was and it was profitable. WeWork was valued nearly x13 higher than IWG – and they were not profitable. Questions were being raised at this difference.

Image courtesy of Bloomberg Originals

Research into the company’s financials, which include how much money it spends and makes, is always done. A look into WeWork’s financials caused investors to worry and pull out their investments from the company. $690 million lost in first 6 months of 2019, brining overall losses to over $3bn.

It led to:

· A decrease in confidence from investors. Was the company actually ready to go public?

· Investors pulling out their money. The $47bn valuation they had received dropped, to around $8bn. It led to a valuation loss of more than 90%

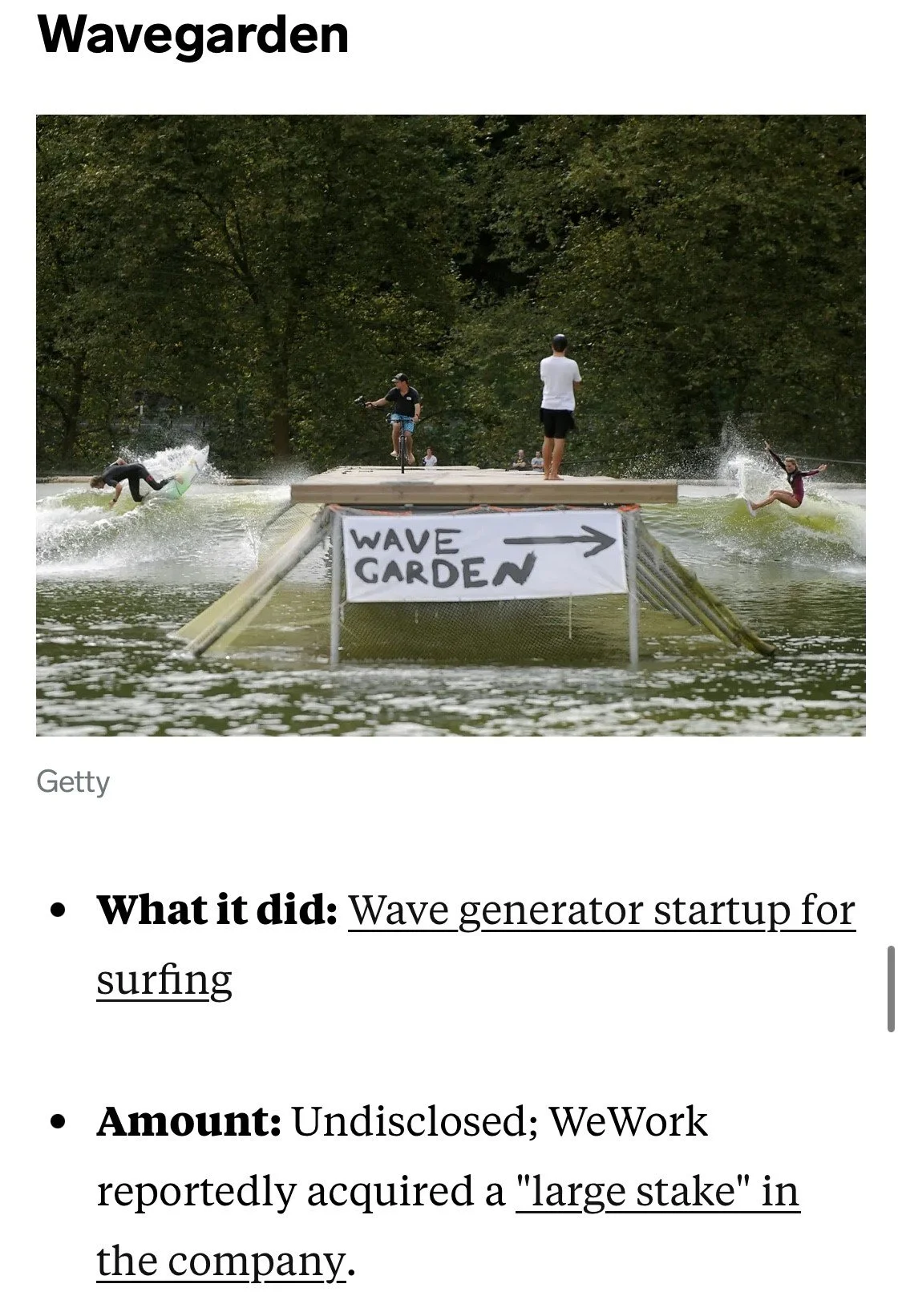

· The ousting of Adam Neumann as CEO. It was revealed that he trademarked the word “We” and sold it to the company for almost $6 million. He went on a personal endeavour and bought a wave generator start-up, an investment that wasn’t relevant to WeWork as a business. It was these dealings and more that led to his resignation as CEO In September 2019.

· A restructuring. This led to many losing their jobs and ventures such as WeGrow, closing down.

· SoftBank bailing the company. They paid $9.5bn to keep the company afloat. Some of the startups they had acquired were sold back

· A postponement in their IPO. They eventually went public through a Special Purpose Acquisition (SPAC) in 2021, with a valuation of just $9 bn.

Image courtesy of Business Insider

My thoughts so far:

I think WeWork’s story is a bittersweet one. For a few years, I would see buildings with the title “WeWork” in front of it and I’d wonder what it was. I later found out what they do after doing a bit of research later on of course. I guess co-working spaces never really appealed to me then (a main reason being that I was a university student outside of London). But my interest peaked in 2022.

WeWork started on a decent footing, but their aggressive expansion has shot them in the foot. Gaining investment is one thing, but knowing how to wisely spend the investment is something different. I believe that they should have had more experienced people to oversee how they were spending the money. If they had , then they could have saved themselves from burning through a lot of cash and putting the company where it is now.

Where they are today

We had to take a trip down memory lane to give you a better understanding of where they are today.

Two months ago, the company said they had “substantial doubt’ about its ability to continue with operations over the next coming year. Why?

· The pandemic. With customers working from home during lockdown and a decrease in demand from them post-lockdown, WeWork has struggled to attract the same numbers they were seeing prior to 2020.

· Remote working is on the rise. According to Forbes, (as based on studies conducted in the US) 12.7% full time employees work from home, while 28.2% are hybrid workers. What is clear is that working from home is becoming much more normalised. Some reasons may be down to increased flexibility and a decrease in costs with commuting, for example. Why pay for a co-working space when I can just work from home?

· Increased competition. WeWork was once hailed as “the office of the future”. This title is no more, just as WeWork may be no more. Newer companies such as AndCo and even companies that were in the industry before WeWork has, have been rising in popularity. The competitors tend to offer much cheaper prices, better locations and amenities to lure customers away.

· Higher inflation and interest rates. This has meant that companies have had to pay higher interest payments to their creditors and pay higher in costs to run the business. This has taken its toll on many, with some filing for bankruptcy. The question is, will WeWork be next?

A look at the Co-Working industry

WeWork used to be a market leader, now their influence and dominance has waned. Newer competitors have emerged within the industry. For example, WorkSpace , SpaceWorks, Uncommon and AndCo. It can even be argued that such co-working spaces offer even more attractive spaces, such as panellist discussions.

I believe that the co-working market will increase in size and in demand. The pandemic has resulted in a lot of change and remote working is one of them. I believe it is here to stay. Employees don’t just like it when businesses offer hybrid or fully remote working- they see this as a necessity. The flexibility it offers is very appealing, and in an era where mental health is being talked about more and more, it’s no wonder that people are being more cautious of what companies offer when deciding to work for them or not.

A little caveat - out of all of the new co-working companies I have just mentioned, I have the AndCo app on my phone. Even though I haven’t had the pleasure of experiencing it just yet, I love how there are a wide range of locations, you can get % off food, drinks and even hotels and they offer networking opportunities too. (Please note, this is not an advertisement by the way, I wish though!

I have the WeWork app on my phone and I was actually shocked at how much they charged to use a desk for the day. What I am trying to say is, competitors are offering much more attractive features and prices and its drawing customers away. Why pay higher for a co-working space, when you can get the same thing and more, for less? I believe cost is the main incentive for people choosing the newer businesses in the market.

So, what next?

I think there are only two options.

· SoftBank could save the day again. I’ll say this is unlikely. They have invested heavily into the growth of WeWork, however a mismanagement of the investment they had received has led to huge losses for SoftBank. Decreasing confidence in the business led to SoftBank deciding not to buy $3bn in WeWork stock in 2021. SoftBank want to back high- growth businesses that have the potential to scale and do well in the long run. WeWork started off as that, but it has declined in being valuable to SoftBank as time has gone on. One thing is for sure – no one wants to save a failing business…

· They could fall into bankruptcy. If WeWork doesn’t get themselves out of the bind they are in, it could be closing its operations for good. If so, it will leave the doors wide open for newer competitors to come and take their market share. If so, how the mighty fall!

With that being said, I think WeWork could go into liquidation. The looming interest payment sover their heads, a loss in investor confidence, customers being swept away by newer and better competitors. It seems like a deadly mix for WeWork, and it’s only a matter of time until WeWork is no more.

That’s it for this week, I hope you have enjoyed this week’s Insight!

What are your thoughts on the story? Do you think WeWork will fall under? Or will SoftBank or another investor come and save the day?

Until next time, remember to stay curious!

Further resources:

‘WeWork says it ‘doubts’ it can stay in business’ - YouTube video by Bloomberg Television

‘How WeWork founder Adam Neumann lost the company $39 billion in one year’ - YouTube video by Forbes

‘The WeWork Business Model’ - Article by Coworking Resources

‘WeWork announces 1-for-40 reverse stock split to avoid getting kicked the New York Stock Exchange’ - Article by CNN

DISCLAIMER:

This blog is for educational purposes only. What I post is not financial, investing or legal advice.

This blog isn’t written by an individual who has years of experience within the corporate world. Nor is it written by someone who has a lot of accolades or academics behind her within these fields. However, it is written by one who has a desire to better understand these industries and has just decided to share her journey with others.